Virtual CFO Vs Traditional CFO: Which is better for your business?

Managing the finances of the company effectively while handling other core aspects of the business becomes very difficult for the founders.

This is where the role of Virtual CFOs comes into the picture.

Virtual CFOs bring their expert advice, suggestions and solutions in the domain of financial management to the company at a very affordable price.

Startups can benefit from these services immensely and improve their cash flow management, tax structure and planning, investment strategies, financial budgeting, planning, forecasting and enhance the overall financial decision-making of the company.

In this article, we will read more about Virtual CFO Services, how they can help in improving the financial decision-making in a company, and discuss why you need them.

The financial requirements of any company have been traditionally hired by a Chief Financial Officer or CFO.

But with the increasing trends of digitization in startups and SMEs, the concept of hiring Virtual CFOs for a company is on the rise.

Before arriving at the final decision of choosing between a traditional CFO and a Virtual CFO for your business, it is very crucial to consider various areas including the size of the organization, its operational area, and its current requirements.

The Virtual CFOs are proving to have a great edge over the traditional CFOs in various domains, especially for small and medium businesses.

In this article, we will talk in detail regarding the difference between the services offered by a traditional and a Virtual CFO.

Who is a CFO?

A Chief Financial Officer or a CFO is a senior financial executive responsible for handling all the financial management roles from accounting, budgeting, tax filing, and investments to all the financial planning, analysis and reporting.

It serves as the financial leader for the organization and helps in making wise, long-term decisions for the company, boosting its growth and overall profits.

A recent study conducted by CB Insights found poor financial management as the main reason why 38% of startups fail each year.

These statistics highlight the importance of hiring a good chief financial officer for your company to ensure the long-term success of the company.

Earlier, a company would mostly hire a full-time, in-house CFO for their business to look after their financial management.

But in recent days, with the rise in digitization, technologies and globalization, many companies are looking forward to hiring a Virtual CFO.

The main reason for the popularity of the Virtual CFO especially among the SMEs is their cost-effectiveness, flexibility in working part-time virtually, and their ability to provide expert financial assistance to all types of businesses.

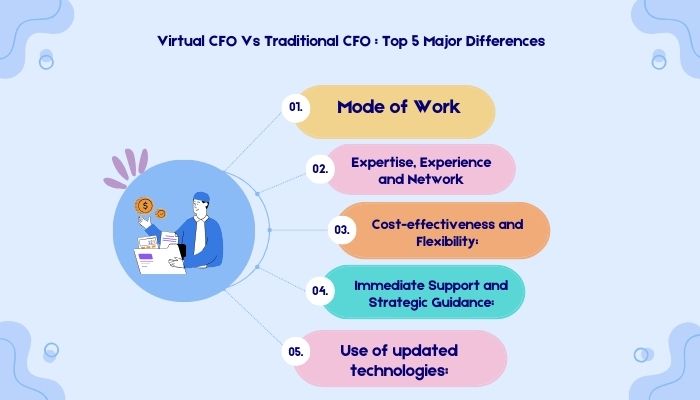

Virtual CFO Vs Traditional CFO: Top 5 Major Differences

A traditional CFO is an in-house chief financial officer who works as a full-time employee for the company and helps with its financial management. A professional Virtual CFO is a financial expert who works on a part-time or project basis for the companies and provides their services remotely.

Given below are 5 major areas where the differences between the services offered by a traditional and a Virtual CFO.

1. Mode of Work:

A traditional or in-house CFO works full-time in an offline setup within the organization, close to other employees whereas a VCFO is a financial expert who works remotely for the company, either on a part-time or project basis, as per the company’s needs.

2. Expertise, Experience and Network:

A traditional CFO works for only a specific company throughout their lifetime, they lack a wide range of knowledge and experience of the industries beyond their job scope. They instead have a deep, specialised knowledge of the specific company or industry they are working for.

Since Virtual CFOs work with multiple clients from several industries simultaneously, they have varied experiences which enhances their expertise in a wide range of industries.

Thus, they have a great understanding of the overall business and the general market trends.

A Virtual CFO Service also brings to on table their vast network in the industry and might help the businesses in raising investments or funds.

3. Cost-effectiveness and Flexibility:

A traditional CFO is hired on a full-time basis thus drawing full-time salary, perks, office space, and other company benefits and resources every month. This can particularly be costly for the small and medium businesses.

Since a VCFO gets hired as per the company’s needs for a limited amount of time, on a project or weekly basis, they are more affordable for the businesses and prove to be cost-effective in the long run.

They are more flexible and adaptable as per the company’s needs and help in scaling the businesses at minimal costs.

4. Immediate Support and Strategic Guidance:

A traditional CFO provides more hands-on support for the company on-site, especially in the case of emergencies and is available to provide guidance and suggestions across the table.

Though a VCFO might not be able to sip a cup of tea with you across the table, they also provide their 24*7 personalized helpline solutions for the clients and make sure every query and urgency of the client is handled personally with accuracy. An offline presence is the only thing that is lacking here.

5. Use of updated technologies:

A traditional CFO is mostly found to be less updated and familiar with the latest advanced technologies in the market due to a lack of exposure to diverse industries.

But Virtual CFOs keep themselves up-to-date with all the advanced technologies and AI to thrive in the market.

They effectively use this knowledge to provide top-notch financial management services and strategies to multiply the profits of their client’s businesses.

They mostly have cloud-based software to give real-time financial analysis and reporting.

Which one should you choose for your business?

The services of both traditional and Virtual CFOs come in with their pros and cons. While deciding on choosing between a Virtual and a traditional CFO for your company, make sure you keep in mind all the points mentioned above.

If the size of your business lies in the small to medium category, it is best to consider hiring a VCFO for cost-savings and increased efficiency. But if your business has a large annual turnover and money is not a problem, you can also consider going with the option of an in-house CFO.

Conclusion:

A Chief Financial Officer plays a crucial role in the financial planning and management of the company. With the advancement in technologies and digitization, there is a trend in the rise of demands for Virtual CFOs by the small and medium startups these days.

Both the traditional and Virtual CFOs come in with their own set of advantages and disadvantages. While a Virtual CFO is more cost-effective, an in-house CFO might provide better hands-on support for the company. Ultimately, the decision will depend upon the circumstances and needs of your business currently

If you are a business owner and looking for a cost-effective Virtual CFO Service for your business, CA Manish Mishra is where all your requirements will be met.

Make the Right CFO Decision for Your Business Today!

Unlock the path to financial success by understanding the differences between virtual CFO and traditional CFO services. Take the first step towards optimized financial management now!

Recent Posts

Related Posts

Quick Links

Contact

+91 98181 18403

Bhutani Alphathum Tower B – 510,511 Sector 90 Noida

Subscribe To Our Email List

For Latest News & Updates

© 2024 CA MANISH MISHRA – All Rights Reserved.

- Privacy Policy

- .

- Terms & Conditions