Curious about the rise of Family Investment Funds in India’s GIFT City? Explore our guide for insights into this wealth management revolution. Discover how Family Investment Funds are reshaping investment strategies and financial futures.

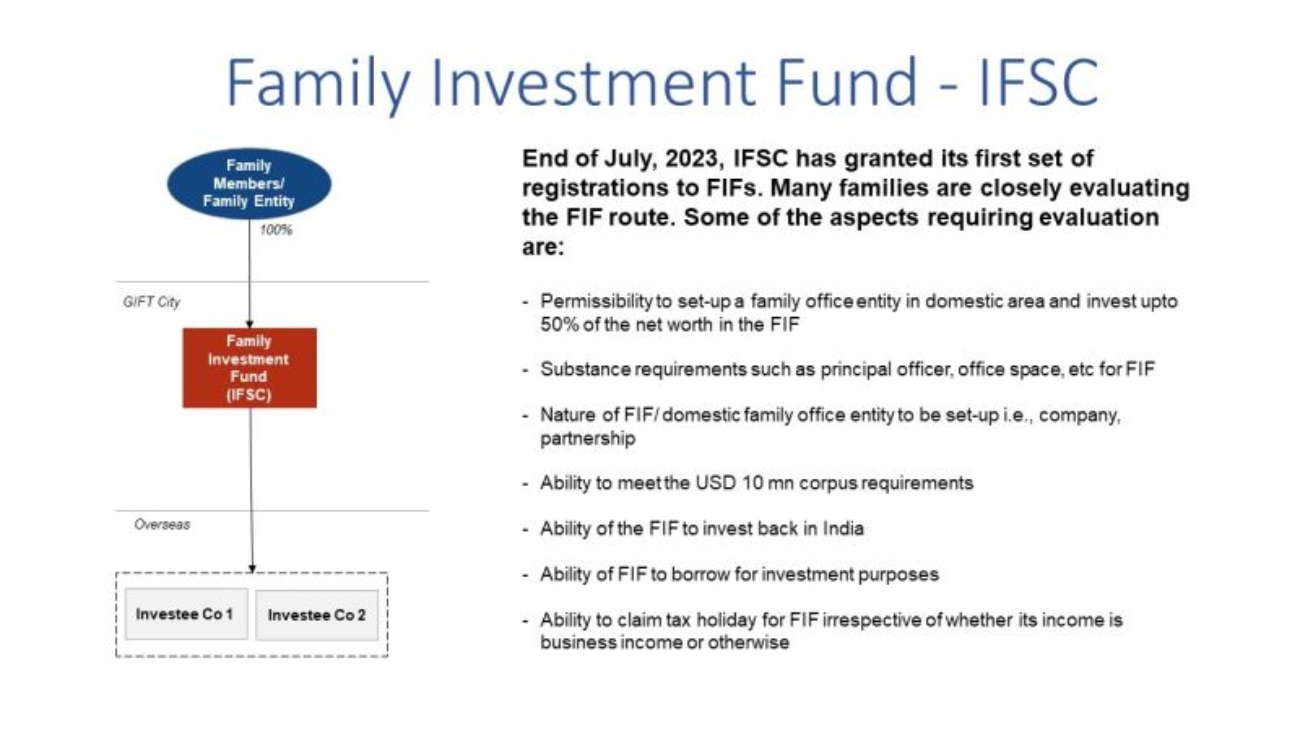

In India, a significant shift is occurring among wealthy individuals and family offices in their approach to wealth management, investments, and taxes. One noteworthy development is the increasing preference for fund structures over direct investments from a company’s balance sheet. Family offices are now eyeing GIFT City, India’s pioneering International Financial Services Center (IFSC), as an avenue to facilitate organized global investments. Central to this transformation are the Family Investment Funds (FIFs), self-managed funds that have gained traction within the IFSC framework. This article delves into the key aspects of this financial revolution and the associated tax framework.

Family Investment Funds (FIFs) in the IFSC

Establishment and Structure

FIFs within the IFSC are established as self-managed funds that pool resources exclusively from a single family. These funds can adopt various permissible structures defined by the International Financial Services Centres Authority (IFSCA), including companies, contributory trusts, LLPs, and more. They have the flexibility to operate as closed or open-ended schemes and invest in a wide array of assets such as securities, shares, bullions, and others.

IFSCA’s Regulatory Relaxations

The IFSCA has introduced a series of regulatory relaxations to encourage the establishment of FIFs in the IFSC, as outlined below:

-

- Expansion of ‘Single Family’ Definition: The previous definition of a “single-family” was limited to individuals with direct lineage from a common ancestor, including spouses, children, stepchildren, and adopted children. Now, this definition encompasses entities such as sole proprietorships, partnership firms, companies, LLPs, trusts, or corporate bodies controlled by individuals from the same family, allowing them to have a “substantial economic interest.”

-

- Protection of Minority Non-Family Members: To safeguard the interests of non-family members holding up to 10% economic interest in the single-family’s entity, FIFs must disclose investment risks and offer an exit strategy. The exit can only be offered by those holding a minimum of 90% interest in the entity, with the acquisition price determined by an independent third-party service provider.

-

- Inclusion of Non-Family Members’ Contributions: FIFs can now accept contributions from individuals outside the single family, solely for allocating economic interest to FIF employees, directors, the fund management entity (FME), and others providing services. These contributions are limited to 20% of the FIF’s profits and must align with the FIF’s internal policies.

-

- Setting up Additional Investment Vehicles: FIFs can establish additional investment vehicles, allowing flexibility in structuring economic interest allocation based on taxation preferences, regulatory requirements, and documentation complexity.

-

- Procedural Requirements: Before commencing investment activities, individuals from the single family contributing to the FIF need to provide an undertaking acknowledging their understanding of the risks and regulatory measures unique to FIFs. This streamlines operations and ensures risk awareness.

The Pioneers: NR Narayana Murthy and Azim Premji

Notably, the family offices of billionaire NR Narayana Murthy and Azim Premji are at the forefront of this trend. They are poised to establish the first Family Investment Fund (FIF) in GIFT City. FIFs in GIFT City enjoy the privilege of investing in assets both within India, the IFSC, and globally.

Family Offices and Family Investment Funds

What is a Family Office?

In essence, a family office is a private wealth management advisory firm catering to ultra-high-net-worth individuals (HNWI). Distinct from traditional wealth management, family offices offer comprehensive solutions to manage the financial and investment needs of wealthy individuals and families.

What is a Family Investment Fund?

Family Investment Funds (FIFs) allow individual investors to contribute up to $250k, while family-owned entities with at least 90% ownership can contribute up to 50% of their net worth. FIFs must maintain a minimum capital of $10 million within three years of operation.

GIFT City: A Catalyst for Change

GIFT City, Gujarat, stands as a project of national significance and a cornerstone of India’s journey towards becoming a developed nation. The city’s unique tax framework has played a pivotal role in attracting both domestic and international investors.

Tax Framework in GIFT City

Direct Tax

-

- Units in IFSC enjoy 100% tax exemption for ten consecutive years out of fifteen.

-

- MAT/AMT at 9% of book profits applies to companies and others setting up units in IFSC.

-

- Dividend income distributed by IFSC companies is taxed in the hands of shareholders.

-

- Certain incomes earned by specified funds in the IFSC are exempt from surcharge and health and education cess.

Indirect Tax

-

- No GST on services received by units in IFSC.

-

- GST is applicable on services provided to DTA (Domestic Tariff Area).

Other Tax Incentives

-

- State subsidies are provided to units in IFSC, covering lease rental, PF contribution, and electricity charges.

- Investors benefit from exemptions from STT, CTT, and stamp duty for transactions carried out on IFSC exchanges

The rise of Family Investment Funds (FIFs) within the IFSC framework in India is reshaping the landscape of wealth management, investments, and taxation. These innovative financial structures, coupled with the advantageous tax framework in GIFT City, have piqued the interest of prominent family offices. As billionaires like NR Narayana Murthy and Azim Premji venture into the world of FIFs, GIFT City’s status as a global financial hub is set to soar, ushering in a new era of wealth management for India’s affluent families.

The regulatory relaxations, extended definitions, and tax incentives provided by the IFSCA create a conducive environment for the growth of FIFs, ensuring the protection of both family and non-family members’ economic interests. With these developments, GIFT City continues to fulfill its mission as a beacon of India’s economic progress.

Recent Posts

Related Posts

All You Need to Know About Insurance Intermediaries

Insurance sector is a complex world, within which lies various insurance products and regulations making it a confusing choice for consumers to decide in. Without proper guidance and expertise, it can become almost difficult for consumers to make an informed choice about insurance coverage which can lead to costly mistakes. But don’t worry. There’s a solution and that is intermediaries in the insurance sector.

SEBI Intermediaries: A comprehensive guide for investors

Are you looking to invest in the financial market or want to become an intermediary? But feeling that it is an overwhelming and a complex task? GenZCFO is here to rescue you. We are a team of trusted guides ensuring every step you take is in the right direction.