How to Leverage Telco Based Data for Credit Scoring

Credit scoring might sound a bit daunting to some, but it’s essentially a tool used by lenders to decide how likely you are to repay a loan. This score can affect not only your ability to get a loan but also the interest rates you’ll be offered. It’s like a financial report card that follows you through life, impacting the opportunities available to you in terms of buying a home, getting a car, or even starting a business.

The importance of having a good credit score cannot be overstated. It opens doors to better financial deals and shows lenders that you’re responsible with money. Think of it as a key to unlocking financial opportunities. Without a decent score, those doors can remain firmly closed, or you might find yourself paying more for the privilege of borrowing money.

In summary:

- Credit scores are critical for securing loans and favorable interest rates.

- They reflect your financial reliability to lenders.

- A good score can significantly ease your path to major life milestones.

Potential of utilizing telecom data for credit scoring

In today’s world, where traditional credit scoring can often leave many unbanked or underbanked individuals in a financial bind, telecom data emerges as a beacon of hope for broader financial inclusion. This data, generated from mobile phone usage, offers a goldmine of insights into customer behavior, spending habits, and reliability. By analyzing various aspects such as call patterns, bill payments, data usage, and recharge frequency, telcos can provide a comprehensive picture of an individual’s financial behavior.

This unconventional but potent data can be especially transformative in regions where banking infrastructures are sparse but mobile phone usage is high. For lenders, this data translates into an opportunity to assess creditworthiness more inclusively, considering not just traditional credit history, but real-life indicators of financial responsibility and stability.

The result?

A more nuanced and inclusive approach to credit scoring that can unlock unprecedented financial opportunities for millions worldwide.

Development and implementation of a credit scoring solution based on telecom data

Developing a credit scoring model that leverages telecom data is an exciting yet complex venture that requires a multi-faceted approach. Here’s a step-by-step snapshot of how such a solution can come to life:

- Data Collection and Privacy Compliance: The first step involves collecting telecom data while strictly adhering to data protection and privacy laws. Ensuring users’ informed consent is crucial for ethical considerations and legal compliance.

- Data Analysis and Model Building: Using advanced analytics and machine learning, this phase involves analyzing the collected data to identify patterns and insights related to financial behavior. The goal is to build a predictive model that can accurately assess an individual’s creditworthiness based on their telecom data.

- Integration with Financial Institutions: Once the model is developed, the next step is to integrate it with the systems of banks or microfinance institutions. This integration allows these financial bodies to use the telecom-based credit score in their lending decisions.

- Ongoing Refinement: Like any model, a telecom-data-based credit scoring system needs continuous refinement and updating. By constantly analyzing new data and outcomes, the model can evolve to become more accurate and reflective of true credit risk.

By carefully developing and implementing a credit scoring solution that taps into the rich vein of telecom data, financial institutions can significantly enhance their lending practices. This not only leads to better risk management but also paves the way for a future where financial products and services are accessible to a broader segment of the society, fostering greater financial inclusion.

Understanding Telecom Data

Telecom data, in its broadest sense, includes a wide range of information generated by interactions through telecommunications networks. This encompasses call logs, message histories, data usage patterns, bill payment histories, and even the types of services customers subscribe to. All these bits and pieces of information collectively sketch a user’s digital footprint, hinting at their behavior, preferences, and reliability.

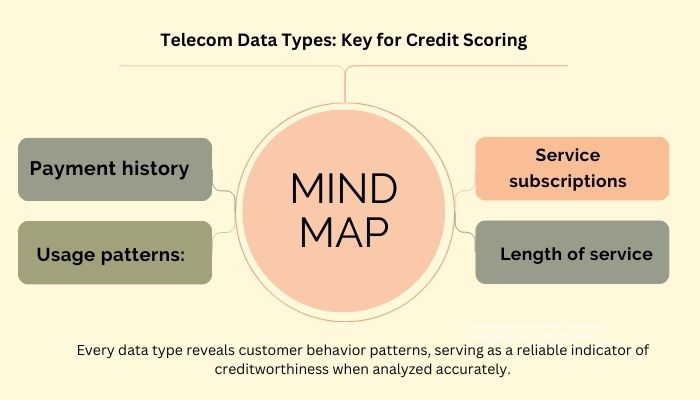

Types of telecom data and their relevance for credit scoring

There are several types of telecom data that are particularly relevant for credit scoring. These include:

- Payment history: Consistent bill payments can indicate financial stability.

- Usage patterns: Frequency and timing of calls, messages, and data usage can reflect lifestyle and financial priorities.

- Service subscriptions: Types of subscriptions can suggest income levels and spending habits.

- Length of service: Long-term relationships with a telco provider can demonstrate stability.

Each type of data offers insights into customer behavior, which, when analyzed correctly, can serve as a proxy for creditworthiness.

Challenges and considerations when working with telecom data

While promising, leveraging telecom data for credit scoring is not without challenges. Privacy and consent are significant concerns, as is the accuracy of inferring financial behavior from telecom usage. Additionally, the diversity in data formats and the volume of data can pose technical challenges for processing and analysis.

- Data Quality: Telecom data can be noisy and incomplete. Missing values, inaccuracies, and inconsistencies need to be addressed to ensure the reliability of the analysis and models built upon it.

- Feature Engineering: Extracting meaningful features from telecom data can be complex. It requires a deep understanding of the domain and may involve transforming raw data into relevant predictors for creditworthiness assessment.

- Model Interpretability: Building interpretable credit scoring models with telecom data can be challenging due to the complexity of the features and their interactions. Ensuring transparency and explainability in model predictions is important, especially for regulatory compliance and customer trust.

- Bias and Fairness: Telecom data may reflect biases inherent in the system, such as demographic disparities in access to services or network coverage. Care must be taken to mitigate biases and ensure fairness in credit scoring decisions.

- Model Validation: Validating credit scoring models trained on telecom data requires careful evaluation to ensure their predictive accuracy, generalizability, and robustness across different segments of the population.

- Integration with Traditional Data: Integrating telecom data with traditional credit data sources (e.g., credit bureau data) poses integration challenges. Ensuring data compatibility and consistency across different sources is necessary for building comprehensive credit scoring models.

- Regulatory Compliance: Compliance with regulatory requirements specific to the telecom industry, such as telecom regulations and consumer protection laws, adds another layer of complexity to credit scoring using telecom data.

Need for Innovation in Credit Scoring

Innovations in credit scoring leverage alternative data and advanced analytics to enhance accuracy, inclusivity, and fraud detection, while streamlining processes for lenders and improving the customer experience.

- Inclusivity: Traditional credit scoring models often overlook individuals with limited credit histories or unconventional financial behaviors. Innovations can help incorporate alternative data sources, such as utility payments, rental history, or even social media behavior, to assess creditworthiness more accurately and include a broader range of individuals.

- Accuracy: Conventional credit scoring models rely heavily on historical financial data, which may not always reflect an individual’s current financial situation or ability to repay debts. By integrating real-time data and advanced analytics techniques like machine learning, credit scoring can become more precise in predicting credit risk.

- Risk Management: The financial landscape is constantly evolving, and new forms of credit and financial products emerge regularly. Innovations in credit scoring can help lenders adapt to these changes by providing more comprehensive risk assessments tailored to specific products or market segments.

- Fraud Detection: As fraud techniques become increasingly sophisticated, traditional credit scoring models may struggle to identify fraudulent applications accurately. Advanced algorithms can analyze patterns and anomalies in data to detect potential fraud more effectively, protecting both lenders and consumers.

- Regulatory Compliance: Regulatory requirements around consumer data protection and fair lending practices continue to evolve. Innovative credit scoring approaches should adhere to these regulations while still providing useful insights for lenders.

- Customer Experience: Simplifying the credit application process and providing faster decisions can enhance the overall customer experience. Innovations like alternative credit scoring methods or automated decision-making can streamline the application process and reduce the time required for approval.

- Economic Impact: Access to credit plays a vital role in driving economic growth and opportunity. By improving the accuracy and inclusivity of credit scoring, innovative approaches can help stimulate lending to individuals and businesses, fostering economic development.

Overall, the need for innovation in credit scoring is clear, driven by the desire for more accurate risk assessment, greater financial inclusion, enhanced customer experience, etc. As technology advances and new data sources become available, there’s significant potential to revolutionize the way creditworthiness is evaluated, benefiting both lenders and borrowers alike.

Limitations of traditional credit scoring models

Traditional credit scoring models rely heavily on credit history, loans, and repayment records. However, they often miss out on a broader picture of an individual’s financial behavior, especially for those with limited or no formal credit history. This exclusion creates barriers to financial inclusion for underserved or unbanked populations.

Advantages of integrating alternative data sources, like telecom data

Integrating telecom data into credit scoring offers several advantages:

- Wider inclusion: It enables people without traditional credit histories to prove their creditworthiness.

- Dynamic assessments: Telecom data can provide up-to-date insights, offering a real-time perspective on an individual’s financial health.

- Behavioral insights: Beyond just financial transactions, telecom data reflects lifestyle choices that correlate to financial responsibilities.

Addressing the shortcomings of traditional credit scoring with telecom data

Telecom data bridges the gap left by traditional credit scoring methods by offering a more nuanced view of individual’s financial behaviors. It not only enhances financial inclusion by considering those previously invisible to credit systems but also provides lenders with a richer, behaviorally informed basis for making loan decisions. The integration of telecom data into credit scoring systems represents a significant step towards a more inclusiveand fair financial ecosystem.

Architecting a Telecom Data-Driven Credit Scoring Framework

Telecommunications (telco) data presents a goldmine of insights on customer behavior that can revolutionize credit scoring models. Creating a framework that effectively harnesses this data involves several critical steps, from integration and preprocessing to advanced feature engineering.

Strategies for seamless data integration and preprocessing

The first step involves the integration of telco data with traditional financial data, ensuring a smooth preprocessing pipeline. This should include:

- Aggregating data from various sources while maintaining data integrity and confidentiality.

- Cleaning the data to remove inaccuracies and inconsistencies, ensuring the dataset is primed for analysis.

- Normalizing data to enable meaningful comparisons across different scales and formats.

- These strategies are foundational in preparing telco data for sophisticated analytical processes that follow.

Advanced feature engineering techniques tailored to telecom datasets

Feature engineering transforms raw telco data into meaningful attributes that reflect a customer’s creditworthiness. Some innovative techniques include:

- Analyzing call and SMS patterns to gauge social and financial networks, which can correlate with financial stability.

- Utilizing mobile money transactions as indicators of financial behavior.

- Extracting geo-location data to understand customer mobility, which can hint at economic activity and stability.

These approaches enable lenders to dive deeper into the financial behaviors hidden within telco data, paving the way for more inclusive credit scoring models.

Ethical and Regulatory Landscapes

Leveraging telco data for credit scoring requires navigating complex ethical and regulatory terrains to ensure that the benefits do not come at the cost of consumer rights and privacy.

Ethical considerations in leveraging sensitive telecom data for credit scoring

The use of telco data raises significant ethical concerns, including the potential for privacy invasion and misuse of sensitive information. It’s crucial for organizations to:

- Maintain transparency with customers about how their data is being used.

- Ensure that the use of telco data enhances financial inclusion without compromising individual rights.

Ensuring compliance with data protection regulations and privacy standards

Compliance with local and international data protection regulations, such as the GDPR in the European Union, is non-negotiable. This involves:

- Implementing strict data access and control measures.

- Regularly auditing data processing activities to ensure compliance.

- Employing data anonymization techniques to protect individual identities.

Strategies for mitigating biases and promoting fairness in algorithmic decision-making

Algorithmic biases can inadvertently perpetuate inequalities. To address this, organizations should:

- Regularly review and adjust algorithms to identify and mitigate biases.

- Utilize diverse datasets to train models, ensuring they accurately reflect the varied customer base.

- Engage in transparency regarding algorithmic decision-making processes to build trust and accountability.

By carefully considering these ethical concerns, compliance requirements, and bias mitigation strategies, organizations can responsibly leverage telco data to enrich credit scoring models, ultimately contributing to broader financial inclusion.

Role of telecom data scoring in Digital Lending

Telecom data scoring is changing the game in digital lending by using information from telecom services to assess creditworthiness. This innovative approach harnesses the power of data, including call patterns, mobile data usage, bill payment histories, and even location information, to provide a more comprehensive understanding of an individual’s financial behavior.

- Expanding Financial Inclusion

One of the most significant impacts of telecom data scoring is its potential to extend financial inclusion. By relying on telecommunications data, financial institutions can reach unbanked or underbanked populations who may not have traditional credit histories. This is incredibly transformative in regions where mobile phone usage is high but access to banking services is limited.

The evolution of telecom data analytics opens up new vistas for collaboration and cross-industry partnerships. Telecommunication companies, fintech firms, traditional banks, and regulatory bodies can work together to refine data collection, analysis, and usage practices. These partnerships can drive innovation in credit scoring models, creating more accurate, inclusive, and efficient financial tools.

- Improved Credit Risk Assessment

Telecom data offers a more dynamic and real-time insight into a user’s behavior compared to traditional credit scoring methods, which often rely on historical financial data. This contemporary approach considers how individuals manage their telecom services, such as timely bill payments or steady usage patterns, to gauge financial responsibility and predict repayment behavior.

This granular view into consumer habits leads to a more nuanced and accurate credit risk assessment, reducing the likelihood of default.

- Faster Loan Decisions

Utilizing telecom data for credit scoring enables lenders to make quicker loan decisions. Since the data is digitally collected and analyzed, the time taken from application to disbursement can be significantly reduced. This speed not only improves the customer experience by delivering rapid financial solutions but also enhances operational efficiency for lenders.

Opportunities for collaboration and cross-industry partnerships in advancing telecom data analytics.

The evolution of telecom data analytics opens up new vistas for collaboration and cross-industry partnerships. Telecommunication companies, fintech firms, traditional banks, and regulatory bodies can work together to refine data collection, analysis, and usage practices.

These partnerships can drive innovation in credit scoring models, creating more accurate, inclusive, and efficient financial tools.

- Speculative outlook on the long-term implications for credit scoring and financial services

The integration of telecom data into credit scoring is just beginning. In the long term, this practice could fundamentally alter the landscape of credit scoring and financial services. As predictive analytics evolve, the reliance on traditional credit information might decrease, making room for a more inclusive and flexible approach to creditworthiness assessment. This shift has the potential to democratize access to credit, leading to a more diverse financial ecosystem.

Moreover, as data analytics techniques advance, the precision of credit scores will improve, enabling lenders to tailor financial products more effectively to individual needs, thus fostering a more personalized financial services environment.

Conclusion

In an age where financial inclusion is very crucial, the innovative use of telco-based data for credit scoring emerges as a game-changer. By tapping into a wealth of information on customer behavior, telcos offer a unique lens through which financial institutions can view potential borrowers. This not only democratizes access to credit but also paves the way for more personalized financial services.

As we venture further into the digital era, the integration of telco data into credit scoring models represents a significant step forward in making financial services accessible to all. Let’s embrace this progress, ensuring a future where financial inclusion is not just an ideal, but a reality for people everywhere.

Unlock Financial Success: Harness Telco Data for Better Credit Scores!

Take control of your financial future by leveraging telco data to boost your credit score. Start now and pave the way for greater opportunities and financial freedom!

Recent Posts

Related Posts

Quick Links

Contact

+91 98181 18403

Bhutani Alphathum Tower B – 510,511 Sector 90 Noida

Subscribe To Our Email List

For Latest News & Updates

© 2024 CA MANISH MISHRA – All Rights Reserved.

- Privacy Policy

- .

- Terms & Conditions