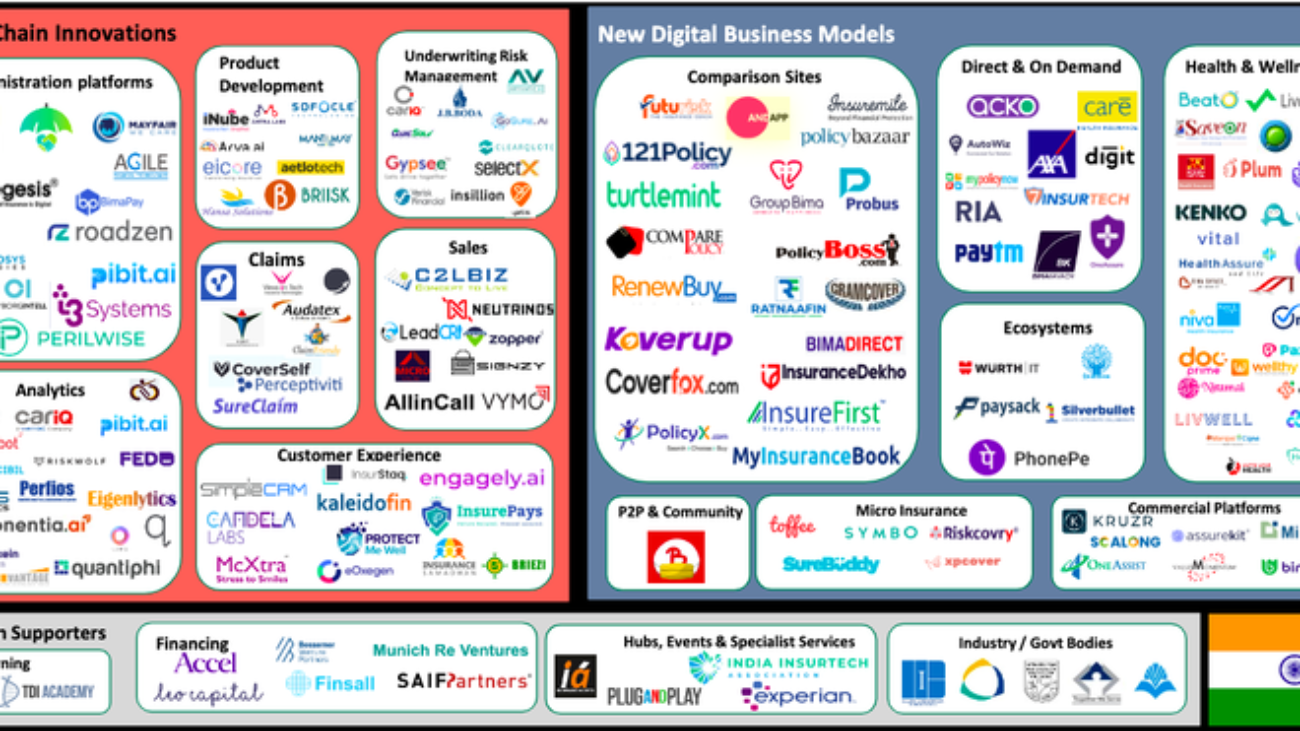

In recent years, the insurance industry has witnessed a digital transformation like never before, giving rise to a new breed of companies known as insurtech startups. With over 142 insurtech startups operating in the country today, including unicorns like Policy Bazaar and promising players like Digit Insurance, Acko, Coverfox, and Turtlemint, the sector is undergoing a profound shift. In this article, we’ll explore how insurtechpreneurs can capitalize the untapped opportunities in the Indian insurance landscape.

First of all Unlearn Everything about Insurance

Insurance is notorious for being a complex product, and this perception is not without reason. Mehmood Mansoori, Member of Executive Management and Group Head at HDFC ERGO, suggests that insurtechpreneurs should shift their focus away from the intricacies of insurance and instead concentrate on understanding the customer’s mindset.

Mansoori emphasizes that customers seek simplicity and ease when interacting with insurance. Their experience should be as seamless as buying a product from an e-commerce platform or making transactions through a mobile wallet. By mastering this customer-centric approach, insurtech startups can set themselves apart in the industry.

Digital is the Key

In an age dominated by digital technologies, the insurance sector can resolve many of its challenges by adopting a digital-first approach. Unfortunately, according to Nobel laureate and economist Amartya Sen, the insurance industry has been slow to embrace these changes.

Manik Nangia, Director & Chief Operations Officer at Max Life Insurance, underscores the importance of putting the customer first and thinking digitally. He highlights that digital disruption has revolutionized how businesses engage with customers. Understanding customer preferences, especially when it comes to human interaction versus digital channels, is crucial for success in the industry.

In essence, insurtech startups must prioritize customers and focus on creating exceptional digital experiences.

Five Key Steps to Launching a Successful Insurtech Startup

Launching an insurtech startup requires a strategic approach. Based on experience, here are five key steps to go from concept to selling policies in record time:

- Launch an MVP (Minimum Viable Product) and Commit to It: Embrace the concept of a Minimum Viable Product, even if you’re a perfectionist. Going live quickly, albeit with some imperfections, allows you to gather real customer feedback and adapt accordingly.

- Create the Right Team: Assemble a team with a mix of insurance and non-insurance expertise. Challenge the status quo while maintaining compliance with regulations.

- Build a Positive Relationship with Regulators: Regulatory compliance is essential in the insurance industry. Establish a positive working relationship with regulators to ensure a smooth market entry.

- Stay True to Your Vision: Maintain a clear vision for your startup and ensure that your team remains focused on the ultimate goal. Test everything against your vision, even if it requires extra effort.

- Know Your Numbers: While initial assumptions are necessary, closely monitor your financial metrics. Be prepared to adjust your budget and resource allocation based on real-world data.

Collaboration is Key

To succeed in the evolving insurtech landscape, all stakeholders—insurers, insurtech startups, regulators, and government bodies—must work collaboratively. Insurtechs can develop innovative solutions, embrace partnerships, prioritize profitability, and proactively address compliance and governance. Insurers, on the other hand, can engage in joint innovation, adapt to a two-speed world, and contribute to shaping regulatory frameworks.

In conclusion, the insurtech revolution in India presents a wealth of opportunities, but success requires a customer-centric, digitally-driven, and collaborative approach. By following these principles and steps, insurtech startups can navigate the complexities of the industry and thrive in this new era of insurance.

Recent Posts

Related Posts

All You Need to Know About Insurance Intermediaries

Insurance sector is a complex world, within which lies various insurance products and regulations making it a confusing choice for consumers to decide in. Without proper guidance and expertise, it can become almost difficult for consumers to make an informed choice about insurance coverage which can lead to costly mistakes. But don’t worry. There’s a solution and that is intermediaries in the insurance sector.

SEBI Intermediaries: A comprehensive guide for investors

Are you looking to invest in the financial market or want to become an intermediary? But feeling that it is an overwhelming and a complex task? GenZCFO is here to rescue you. We are a team of trusted guides ensuring every step you take is in the right direction.