How to Start an Insurance Business in India

Embarking on the journey of starting an insurance business in India demands a comprehensive understanding of the country’s unique insurance landscape. India’s insurance sector is not just vast but also complex, characterized by a myriad of regulations, a diverse market base, and significant growth potential.

Understand the Insurance Business in India

Before diving into the intricate world of insurance business in India, it’s crucial to familiarize yourself with several key aspects:

- Regulatory Framework: The Insurance Regulatory and Development Authority of India (IRDAI) is the central body overseeing the insurance industry. Understanding IRDAI’s regulations, guidelines, and compliance requirements is step one for any aspiring insurance entrepreneur.

- Market Dynamics: India’s insurance market is divided into various segments including life insurance, general insurance, and health insurance. Each segment caters to different demographics and has its unique needs and preferences. Conducting thorough market research to understand these dynamics is crucial.

- Consumer Behavior: With India’s diverse population, consumer behavior varies significantly across different regions and demographics. It’s important to grasp the insurance needs, purchasing power, and preferences of your target demographic.

- Competition: The Indian insurance market is highly competitive with a mix of public-sector giants and nimble private players. Analyzing your competition can provide insights into effective business models, market gaps, and innovative product offerings.

Having a deep understanding of these aspects will equip you with the foundational knowledge needed to navigate the complexities of starting and scaling an insurance business in India.

Growth of Insurtech (stats).

The insurance technology sector, or insurtech, in India has seen phenomenal growth over the past few years. India is poised to lead the pack among G20 nations in insurance sector growth over the next five years, with a forecasted real-term increase of 7.1% in total insurance premiums by 2028. This surge is notably driven by a projected 6.7% expansion in the life insurance segment, fueled by rising demand for term life coverage and the integration of Insurtech solutions.

This incredible surge is attributed to increasing digitalization, the adoption of advanced technologies by insurance companies, and a growing awareness among consumers about the importance of insurance. The rise in smartphone usage and internet penetration across the country has further fueled this growth, making insurance services accessible to a larger section of the population. As more startups enter the space with innovative solutions, the landscape of the insurance industry in India is undergoing a significant transformation.

Evolution Beyond Conventional Domains like life, health, motor, etc.

The Indian insurance industry is rapidly evolving beyond the traditional domains of life, health, and motor insurance. Innovations in technology and changing customer expectations are driving insurance companies to explore and offer products in previously untapped areas. Today, insurance products cover a wide array of sectors including cyber insurance, agricultural insurance, and even space insurance, catering to the specific demands of diverse clientele.

Additionally, the integration of artificial intelligence and blockchain technology is enabling insurers to enhance efficiency, improve risk assessment, and offer personalized insurance solutions. The focus is also shifting towards micro-insurance products designed to be affordable and accessible to the lower-income segments of the population, thus widening the insurance net.

This evolution marks a significant shift in how insurance is perceived and consumed in India, setting the stage for innovative and inclusive growth in the sector.

Insurance role in India's development

Gone are the days when insurance used to be just a financial safety net for individuals and businesses. Now it’s a significant contributor to India’s socio-economic development.

By pooling resources to cover losses faced by individuals or entities, insurance plays a pivotal role in the nation’s economic stability and growth. It encourages savings and investments, vital for any developing economy. Moreover, insurance companies invest premiums in various sectors such as infrastructure and government securities, providing the necessary funds for development projects. This, in turn, generates employment, stimulates economic activity, and promotes societal welfare.

In the coming years, as insurance penetration deepens, its contribution to socio-economic progress in India is expected to be even more pronounced, fostering an environment where individuals and businesses can thrive without the fear of unforeseen financial setbacks.

Moreover, insurance penetration in rural and underserved areas can foster resilience against unforeseen events and drive economic empowerment at the grassroots level.

Choose Your Insurance Business Model

When venturing into the insurance domain in India, selecting the right business model is crucial. Your choice determines your operational dynamics, regulatory requirements, and market approach. Here are three primary models to consider:

• As an Insurance Provider - Become licensed to sell your own insurance products.

Stepping into the arena as an insurance provider means you’ll be crafting and selling your own insurance policies. This model requires a significant capital investment and thorough compliance with regulatory standards set by the Insurance Regulatory and Development Authority of India (IRDAI).

Obtaining a license from IRDAI is a rigorous process, ensuring that only those with a solid financial grounding and clear operational plans enter the market. As a provider, you have complete control over your product offerings, pricing, and customer engagement strategies, positioning you to build a distinctive brand in the insurance market.

• As an Insurance Aggregator - Sell policies from partner insurance companies.

Choosing to operate as an insurance aggregator is a savvy way to enter the market without the hefty upfront investment of being a provider. Aggregators act as digital marketplaces, offering policies from multiple insurance companies on a single platform.

This model is appealing to customers seeking a one-stop-shop for comparing and purchasing insurance policies. As an aggregator, your primary role is to facilitate convenience, choice, and transparency, helping users make informed decisions. While regulatory requirements are less stringent than for providers, aggregators still need to adhere to specific guidelines and acquire relevant permissions.

This model provides flexibility and scalability without the burden of underwriting risks.

• As an Insurance Broker - Act as intermediary between insurers and customers.

Becoming an insurance broker is akin to being a bridge that connects potential insurance buyers with providers. As a broker, you’ll provide advice, help customers select the right policies, and assist with claims processing.

This model requires earning the trust of both insurers and insureds while maintaining a deep understanding of the insurance market and regulatory landscape. Brokers need to be licensed by the IRDAI and are subject to its regulatory and operational guidelines.

Despite the challenges, this path offers flexibility in terms of the products you can offer and the clientele you can serve, catering to a broad spectrum of insurance needs.

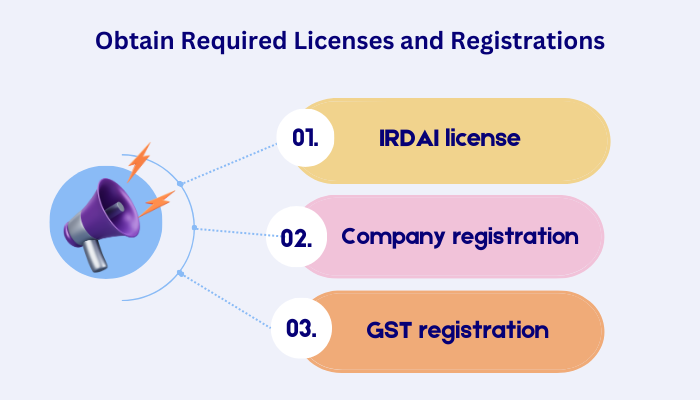

Obtain Required Licenses and Registrations

Starting an insurance business in India isn’t just about having a great idea or an eager market. It’s also about navigating the regulatory requirements to ensure that your business is legit and ready to go. Here’s what you need to focus on:

• IRDAI license - Required to act as an insurance company.

First on your checklist should be obtaining a license from the Insurance Regulatory and Development Authority of India (IRDAI). This is non-negotiable. The IRDAI oversees all insurance-related activities in India, ensuring that companies operate fairly and morally. To get this license, you’ll need to go through a detailed application process, showcasing your business plan, financial projections, and the overall integrity of your proposed insurance business. It’s a rigorous process but essential for establishing a trustworthy insurance company.

• Company registration - Register as public/private limited company.

Next up, you’ll need to formally register your company in India. Deciding whether to opt for a private or public limited company structure will depend on your business goals, funding, and scale of operations. This registration provides your business with a legal identity, making it easier to manage finances, assets, and liabilities.

You can navigate this step with the help of a legal expert to ensure compliance with all the regulations.

• GST registration - For collection and payment of GST.

Lastly, don’t forget about the Goods and Services Tax (GST).

As an insurance business, you’ll be required to collect GST from your customers and remit it to the government. The process involves obtaining a GST registration number, which then needs to be included in invoices and financial documents. Understanding the GST rates for insurance products and services is crucial. So consulting with a tax expert could save you a lot of headaches down the line.

Develop Insurance Products

After crossing the regulatory hurdles, it’s time to focus on what you’re offering to your customers – your insurance products.

• Research customer needs and market gaps

Embarking on comprehensive market research is your first step towards creating relevant insurance products. This involves identifying the specific needs of your target customers and understanding where current offerings in the market fall short.

Look into different demographics, lifestyle patterns, financial behaviors, and risk factors.

What are people most concerned about? What kind of coverage do they wish they had?

This knowledge base will be invaluable as you design your products.

• Design innovative products for target segments

With a thorough understanding of your market and customer needs, you can now proceed to design innovative insurance products. Whether it’s policies with easier claim processes, products that cater to previously underserved segments, or integrating technology for more personalized insurance experiences – your goal should be to fill the gaps identified during your research. Tailoring your products to meet the specific demands of your target segments will not only set you apart from competitors but also significantly increase your business’s chance of success.

• File products with IRDAI to get approval before launch.

Before launching your insurance products in India, it’s imperative to seek approval from the Insurance Regulatory and Development Authority of India (IRDAI).

This regulatory body oversees the insurance industry and ensures compliance with laws and guidelines. Submitting your products for IRDAI approval involves thorough scrutiny to verify compliance with regulatory standards, including pricing, coverage benefits, and terms. By obtaining IRDAI approval, you demonstrate credibility and trustworthiness to potential customers and stakeholders.

This pave the way for a successful and legally compliant entry into the Indian insurance market.

Market and Sell Insurance

Marketing and selling insurance policies in India involves a strategic mix of digital outreach and leveraging the traditional insurance sales force, such as agents and brokers. It’s vital to understand that the insurance landscape in India is highly competitive, and your success will significantly depend on how effectively you can differentiate your offerings and connect with your target customer base.

• Promote through digital marketing and partnerships.

In the digital age, an online presence is non-negotiable. Start with a user-friendly website that details your insurance products and services. Use search engine optimization (SEO) techniques to increase your site’s visibility. Social media platforms, email campaigns, and pay-per-click advertising can also be potent tools in your marketing arsenal. Furthermore, forging partnerships with financial advisors, firms, or even other insurance companies can help in reaching a broader audience. These collaborations can lead to mutual benefits and increase your market penetration.

• Sell through agents, brokers, online platforms.

Traditional agents and brokers remain crucial in the insurance industry. They have the personal touch and expertise that many customers appreciate when making insurance decisions. Training and empowering your sales force with comprehensive product knowledge and selling skills are imperative. Additionally, the advent of InsureTech has opened direct-to-consumer channels. Offering your products online can cater to the digitally savvy consumer and streamline the purchase process.

• Provide excellent customer service.

Outstanding customer service can set your insurance startup apart. From the initial contact through to claims processing, every interaction should be straightforward and responsive. Implementing technology to automate and expedite services without sacrificing personal attention is a delicate balance but achievable and highly rewarding.

Common Challenges Faced by Insurance Startups in India

Starting an insurance business in India comes with its set of hurdles. Understanding these challenges ahead of time and preparing with strategic solutions can improve your chances of a successful launch and sustainable operations.

Mitigating Risks Associated with Starting an Insurance Business

Navigating the regulatory environment, establishing a competitive advantage, and managing operational costs are primary concerns.

Hiring a virtual CFO experienced in the insurance and InsureTech sectors can provide invaluable insight into financial planning, risk management, and compliance. Market research is critical to understanding the needs of your target customers and designing products that meet those needs.

Lastly, technology plays a crucial role in streamlining operations and enhancing customer experience, so investing in the right tech solutions is essential for reducing risks and fostering growth.

Conclusion

Embarking on the journey of starting an insurance business in India can indeed be a challenging yet rewarding venture.

With a keen eye on market dynamics and a solid understanding of the regulatory framework, you’re setting the foundation for a successful business. Remember, thorough market research and compliance with regulations cannot be overlooked. By leveraging the expertise of a virtual CFO for insuretech, you can further streamline your financial planning and ensure your business is on the right path to growth.

In wrapping up, the key to success in the insurance sector lies in being patient, persistent, and adaptive. The landscape of insurance in India is evolving, and with the right strategy, there’s ample opportunity for new entrants to thrive. Keep your focus on understanding your customers’ needs and delivering unparalleled value. By doing so, you’ll not only establish a strong foothold in the market but also make meaningful contributions to the financial security of individuals and businesses alike.

Starting an insurance business in India is a journey worth embarking on. With the right preparation and mindset, the road ahead is full of potential for success and innovation.

Happy venturing!

Transform Your Dreams into Reality: Launch Your Insurance Venture Now!

Get started on your journey to establishing a successful insurance business in India. Follow CA Manish Mishra’s expert advice and turn your aspirations into achievements. Start today and pave the way to financial prosperity!

Recent Posts

Related Posts

Quick Links

Contact

+91 98181 18403

Bhutani Alphathum Tower B – 510,511 Sector 90 Noida

Subscribe To Our Email List

For Latest News & Updates

© 2024 CA MANISH MISHRA – All Rights Reserved.

- Privacy Policy

- .

- Terms & Conditions