Understanding NBFCs: A beginner's guide to Non-Banking Financial Companies

The present banking system of India is not able to fulfill all the financial requirements of the economy. This is where the role of the Non-Banking Financial Companies comes into the picture.

Non Banking Financial Companies are institutions growing at a fast-pace since the last decade and are very powerful in bridging the gaps between the traditional banks and the customers. It plays a very crucial role in India’s financial ecosystem and caters successfully to the varying needs of the businesses and individuals.

In this article, we’ll talk about Non-Banking Financial Companies (NBFCs), it’s functions, how they differ from banks, and the importance of Virtual CFOs in NBFCs.

What is an NBFC?

Non Bank Financial Companies or NBFC is also known as Non Bank Financial Institutions is a company registered under the Companies Act,1956. It provides all the banking services from loans, acquisitions, financing to currency exchanges and retirement planning, but it functions without any license issued by the government. It basically works to bridge the gap between the traditional banks and customers by offering a vast range of financial products and services.

As per the 1934 act of RBI, the Reserve Bank of India holds the authority to control and regulate the Non Banking Financial Companies. Non Banking Financial Companies have drastically increased in number in the recent times, especially after the Great Recession and is constantly helping in catering to all the unmet credit demands in the market.

It functions as a very important part of the financial ecosystem in India. Various examples of Non Banking Financial Companies in India includes Piramal Capital, Mahindra and Mahindra Financial Services, TATA Capital Financial Services, PNB Housing Finance,etc.

Functions of Non Banking Financial Companies:

The Non-Banking Financial companies perform several functions like:

- Financing Assets: Non Banking Financial Companies provide fund for the leasing or purchase of assets like real estate, vehicles, equipments,

or machinery. - Discounting of Invoice and Factoring: By providing the invoice discounting and Factoring services enabling the business to fullfill their working capital requirements and providing liquidity to the the business.

- Credits, Lending and Microfinance: The Non Banking Financial Companies provide flexible credit facilities and lending solutions for both personal and

businesses. NBFCs also specialize in providing financial services and loans to the small and medium enterprises (SMEs),self help groups,low income families,etc. - Investment, Advisory, and Foreign Exchange Services: Services including portfolio management, investment advisory and risk management are provided to the clients. Various foreign exchange services which helps in currency exchange and remittance transactions are provided by the NBFC.

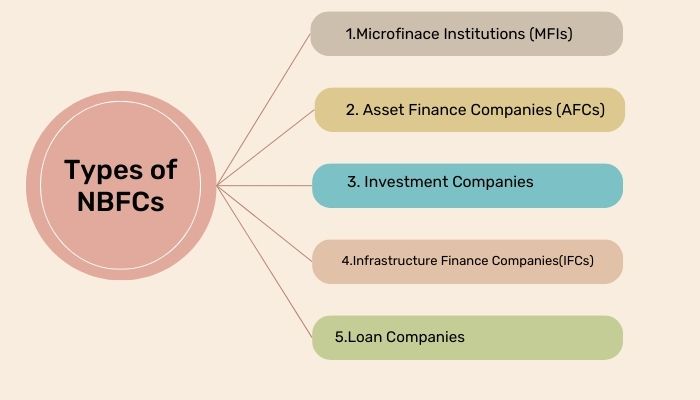

Types of NBFCs in India

The various types of Non Banking Financial Companies in India includes:

1.Microfinace Institutions (MFIs)

It basically targets the economically wekaer sections of the society by providing them various small or micro loans, helping them to expand their small businesses and fosters financial inclusion and financial inclusion.

2. Asset Finance Companies (AFCs)

It is mainly involved in providing financing assets through loans and leases to the Small and Medium-sized enterprises (SMEs) for various tangible assets and offers personalised financing solutions for acquiring assets.

3. Investment Companies

Non Banking Financial Companies help the retail and institutional investors in the management and acquisitions of bonds, stocks, mutual funds and other financial assets.

They also help in increasing the opportunities of investing opportunities and encouraging the practices of investment.

Holding more than 90 percent of its assets in the form of investment in the financial assets in its group companies, debts or equity shares, CICs-SI or Systematic important core investment companies is another important subset of investment companies,playing an integral role in the

financial inclusion process.

4.Infrastructure Finance Companies(IFCs)

This plays an important role in supporting the development of nations infrastructure by funding multiple projects in this domain.

They provide project-specific,long term funding and strengthen the economic progress and overall development of the nation.

5.Loan Companies

They help in bridging the gap between traditional banks and the customers by providing them with personal loans, home loans, education loans and working capitals through project and trade finance.

Differences between NBFC and Banks:

● Both NBFC and Banks provide banking services but for a bank to operate in India, it should have the license but an NBFC can operate without a banking license.

● An Non Banking Financial Companies cannot accept demand deposit from the people and are not covered in the Payment and Settlement Act,2007 (PSS Act) of India.

● Non Banking Financial Companies mostly engagement in lending and investment activities while a traditional bank offers a wide range of banking services.

● A bank can accept and issue cheques while an NBFC cannot.

● A bank can create credit cards through fractional reserve banking while an Non Banking Financial Companies cannot create credit like banks.

● Government insurance schemes may guarantee deposits in the banks and can access payment systems and borrow money from the RBI but no such preferences are provided for the Non Banking Financial Companies.

● The banks are mandated to provide a percentage of their lending to the priority sectors while an Non Banking Financial Companies is not required to follow such regulations.

Problems faced by NBFCs

There are a number of issues faced by the NBFCs.Some of them are mentioned below:

● The number and types of regulatory compliances to be filed for NBFC and the process to follow for the same is difficult to understand and follow.

● The process of getting a license and completing all the documentation is complicated.

● Various small NBFCs struggle to find capital and funding for their institutions.

● Non Banking Financial Companies also face challenges in accessing their market data analytics and liquidity management.

● They also face unfair tax treatment and do not get access of defaulter database

Virtual CFO for NBFCs:

Some of the problems faced by Non Banking Financial Companies today can be easily solved by hiring a Chief Financial Officer for your organization.

With the increase in digitization, the demand for Virtual CFOs for Non Banking Financial Companies is rising exponentially. While providing all the services offered by the traditional CFOs, the Virtual CFOs are more flexible and can be hired as per its specific needs and requirements.

The top Virtual CFOs for NBFCs can be hired from anywhere around the world and at any stage, as per the requirement. They can also be hired on a weekly or project basis to manage the finances of the company.

From managing compliance, operational, IT and financial risks to managing accounting, cash flow while creating growth expansion and growth strategy, a Virtual CFO plays an integral role in the Non Banking Financial Companies or NBFCs.

Conclusion

NBFCs or Non Banking Financial Companies are an integral part of India’s financial ecosystem. It provides a range of financial tailored services and complements the traditional banking system of India.

It helps in various sectors from loans and credits to infrastructure and development, thus contributing to the overall economic progress of the country. With the vast range of functions offered by the NBFCs as discussed above,a need for CFO to manage and overlook the finances

becomes integral.

Hiring a Virtual CFO for NBFCs is one of the best options to consider for your institution.

The team at CA Manish Mishra has experience of handling such projects for a long time. You can contact us at +91 98181 18403 to know how our services can help your institution.

Unlock the Power of NBFCs: Start Your Financial Journey Today!

Discover the world of Non-Banking Financial Companies with our beginner’s guide. Take the first step towards financial empowerment and explore the opportunities that NBFCs offer!

Recent Posts

Related Posts

Quick Links

Contact

+91 98181 18403

Bhutani Alphathum Tower B – 510,511 Sector 90 Noida

Subscribe To Our Email List

For Latest News & Updates

© 2024 CA MANISH MISHRA – All Rights Reserved.

- Privacy Policy

- .

- Terms & Conditions