साहूकारी to Digital Lending

Sneak Peek into the Masterpiece

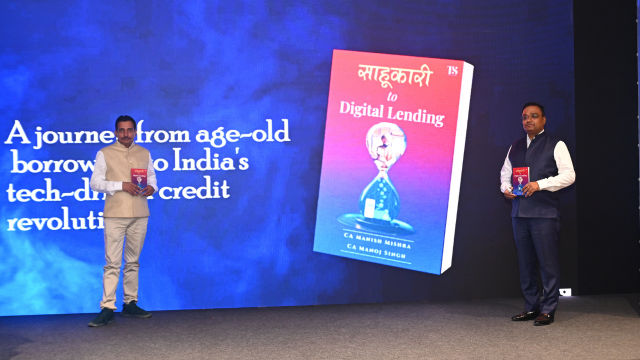

Media Spotlight: Book Release Coverage

Captured Highlights from the Event

Praise for Sahukaari to Digital Lending

"This book masterfully connects India’s deep-rooted lending culture with its booming digital finance space. The transition from sahukaars to AI-based platforms is explained in a way that even non-finance readers can understand. A must-read for students, bankers, and policymakers alike."

“An eye-opener for anyone in finance or fintech!”

"As a professor of finance, I’ve rarely seen a book that balances storytelling, case studies, and technical insight so well. It not only covers regulations and fintech trends but also brings in the human side of lending practices through history. Brilliant work by CA Manish and CA Manoj."

“Finally, a book that speaks both history and future.”

"This book helped me understand credit systems, fintech apps, and how digital lending can be a game-changer for startups. It’s written in simple English and makes learning about finance actually interesting!"

“Empowering and relevant for today’s youth.”

"The authors don’t just explain lending—they make you think. From farmer exploitation to digital credit scoring, every topic is discussed with empathy and clarity. The inclusion of real reforms and RBI guidelines adds major credibility."

“A rich blend of practical insight and ethical reflection.”

"This is not just a book, it's a roadmap. For entrepreneurs, digital lenders, or anyone trying to understand India’s financial evolution, it’s gold. Loved the section on co-lending models and fintech startups."

“A handbook for the new financial India.”

"The chapters on RBI roles, NBFCs, and digital frameworks are clear and up to date. It helped me a lot in my preparation for banking interviews and even gave examples I could quote in the GD round!"

“Great companion for banking exam aspirants.”

FAQ – Everything You Need to Know

It explores the evolution of lending in India—from traditional moneylenders to digital lending platforms—covering technology, regulations, risks, and the future of borrowing.

The book is useful for finance professionals, students, entrepreneurs, policymakers, and anyone interested in how lending is changing in India.

It helps you understand modern lending systems, including digital loans, the risks involved, and how regulations protect borrowers, making you a smarter borrower or lender.

Yes, it covers AI, blockchain, big data, digital KYC, and new lending models like peer-to-peer and microloans.

Absolutely, it explains key legal frameworks and RBI guidelines that govern lending practices in India.

The book highlights how mobile-first lending platforms provide easier credit access to rural entrepreneurs, gig workers, and women.

Yes, the book talks about data privacy, cyber fraud, predatory lending, and how to promote ethical and responsible lending.

The book forecasts a future where lending is personalized, faster, inclusive, and governed by ethical AI.

Yes, it uses real-world case studies to explain challenges and opportunities in the lending sector.

Authors’ Spotlight – The Faces Behind the Words

CA MANISH MISHRA

A Chartered Accountant, Fractional CFO, and fintech regulatory expert with 20 years of experience, Manish is the Founder & CEO of GenZCFO.com. He specializes in financial planning, compliance, and fintech advisory, helping startups and enterprises navigate India’s evolving financial landscape. Passionate about leveraging technology to simplify finance, Manish bridges the gap between compliance and sustainable business growth.

CA MANOJ SINGH

FCA and Virtual CFO with deep expertise in Banking, Financial Services, and Insurance (BFSI), Manoj offers financial consulting focused on regulatory advisory, corporate finance, and investment planning. With extensive experience guiding startups and established firms, he delivers cost-effective financial leadership that drives growth while ensuring compliance.

About the Book: Sahukaari to Digital Lending

Co-authored by Manish Mishra and Manoj Singh, Sahukaari to Digital Lending explores India’s shift from traditional moneylending to modern, tech-enabled digital lending models. The book sheds light on:

The fintech revolution transforming lending accessibility and efficiency

Regulatory frameworks and risk management in digital lending

Emerging trends shaping India’s financial ecosystem

Designed for entrepreneurs, finance professionals, and investors, this book empowers readers to understand and thrive in the new digital lending era.

Experience the Event: Official YouTube Video

Core Concepts Presented in the Book

Get a glimpse into the powerful journey this book takes you on—from the traditional world of Sahukari (money lending) to the modern revolution of digital lending in India. Here’s what you’ll discover inside:

Barter system to commodity money to metal coins

Ancient systems like Rnapatra and Manusmriti laws

Role of Mauryan and Gupta empires in early lending practices

Colonial and post-independence shifts in lending

Evolution of the banking sector in India

Growth of NBFCs, Microfinance, and institutional credit

Retail lending: personal, education, gold, home loans

Commercial lending: MSME, equipment finance, POS lending

Microfinance and financial inclusion strategies

Role of AI, fintech, and automation in loan disbursal

Paperless KYC and mobile-driven credit access

UPI, credit scores, and new-age loan apps

RBI’s role and the Banking Regulation Act

SARFAESI Act, Draft BULA Act, State Moneylenders Acts

Borrower protections and responsible lending reforms

Debt traps and exploitation in informal lending

Gender-inclusive and rural lending insights

Future trends in lending technology and governance

Students seeking financial literacy

Professionals exploring loans and credit

Entrepreneurs and startups looking for capital

Anyone curious about how India’s financial lending system works